Transparency in trading is key.

- Eugene Herrendoerfer

- Jul 29, 2015

- 3 min read

Many people have the notion that investing is risky and I won't disagree but they base this on experiences and actions of others and never find out the facts for themselves. I'm not saying that you should haphazardly open an account with a broker or a company trading forex and hope for the best, in order to know firsthand how much risk forex carries.

No, the best thing to do when you don't have the skill or experience of trading forex, is to find out about the company or trader you doing business with. The first thing to establish is how transparent they are. Anyone can print a statement showing wonderful results but how do you know what really is happening in the background - YOU DON'T. Doing business with a company or trader that can provide a transparent relationship, will ensure greater confidence and less risk because you as the client gets to see everything that is happening.

You will also have to understand how the risk and money management approach of the company or trader works, to further reduce the chances of losing your capital. What I mean by this, is what leverage, margin risk, risk/reward and the stop loss mechanisms are being used. For instance, if you have an account of $1 000 000 and you risk 10% of capital amount at a leverage of 100, then your trade size/lot size will be 100, which means that you going to be earning $1 000 per point/pip you earn on the market. This means that if your trade moves against you by 100 pips and you are stopped out, you will be down 100(lots) = $1 000 per pip x 100 pips =$100 000 (loss). If this is the case and your win/loss ratio is 8/2, then you still making profit, however you would have to be achieving 100 pips with each winning trade. Your risk/reward ratio should also be at least 1/1.

All this being said and done, the ratios of wins to losses, reward to risk, with leverage and margin risk is not easy to achieve like in the example above, so most times you won't find this type of trading results by traders and companies. The only real way to know for sure if a company or trader is doing well is to have the full picture, with all the facts and this can only be found in its detailed statement of trading.

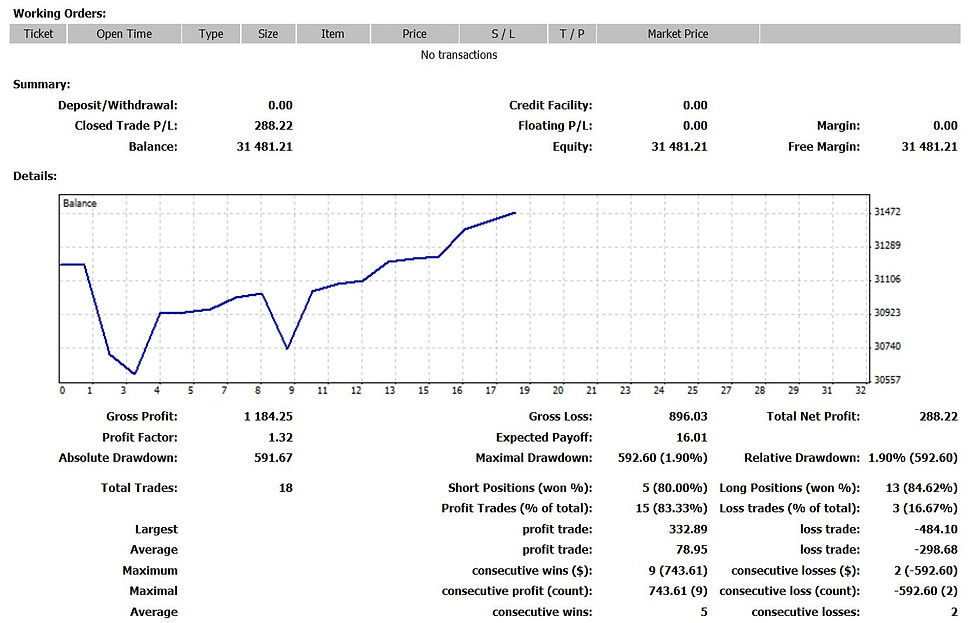

Below you find one example of such a report. It will give you pertinent information about the trading that just the end result (just the balance and the profit) won’t give you. The most important of these is probably the drawdown factor, which is simply the troughs and peaks or lows and highs the investment/trading has done over time. In other words, how far does the investment drop as a percentage.

A couple of months ago I saw the trading report for a company who did not provide the details as per the illustration below and what I found was really scary. They advised people that they only risk 10% of the margin/capital when trading, which is perfectly ok, however the report showed that instead of 10% risk at any given time they were trading 10% per trade entered, of which they had 14 opened at once and so you do the math in terms of risk. These trades stayed open overnight and luckily closed positively but it just shows you how you can be told one thing, whilst something completely different is happening in the background.

I trust that you will consider this before you invest money or if you have funds invested anywhere, make sure to get this information from the trader or company you trust your money with. If you have any question about the information in the report please contact me and I will be more than pleased to assist.

Comments